Understanding Credit Ratings in NCD Investment

24 March, 2025 NCD

3 mins read

Discover key factors to consider before investing in Upcoming NCDs, from credit ratings to returns. Explore Kosamattam Finance’s NCD offerings!

Investing in NCDs is an attractive option for individuals seeking stable returns and lower risk than equity markets. However, before subscribing to an NCD issue, it is essential to assess the issuer’s creditworthiness. One of the most effective ways to evaluate the risk associated with an NCD investment is by looking at credit ratings assigned by reputed agencies. These ratings provide insights into the financial health of the issuer, their repayment ability, and the potential risks of default.

For investors, understanding NCDs and how credit ratings work is crucial for making informed investment decisions. This blog will explore the importance of credit ratings, how they are determined, and how investors can use them to choose the right NCD investment.

What Are Credit Ratings in NCD Investment?

Credit ratings are assessments assigned by credit rating agencies (CRAs) such as CRISIL, ICRA, and CARE to evaluate the creditworthiness of a company issuing NCD investment options. These ratings indicate the level of risk involved in lending money to the issuer.

Key Functions of Credit Ratings

- Risk Identification – They help investors gauge the likelihood of default on an NCD issue.

- Comparative Analysis – Ratings allow investors to compare different NCDs in terms of safety and returns.

- Investment Decision Making – Investors can select the right NCD investment based on their risk appetite.

By thoroughly assessing the credit rating, investors can ensure that their funds are placed in a reliable and secure investment avenue.

How Credit Rating Agencies Evaluate an NCD Investment

Credit rating agencies conduct in-depth research and analysis before assigning a rating to an NCD issue. The key factors they consider include:

- Issuer’s Financial Health – Revenue, profitability, and cash flow analysis.

- Debt Repayment History – Whether the issuer has a strong track record of repaying debts.

- Industry Position & Market Risks – How external market conditions affect the issuer’s financial stability.

- Collateral Security – Whether the NCD is secured or unsecured.

By understanding about NCDs and their evaluation process, investors can make informed choices while reducing investment risks.

Credit Rating Scale and Its Meaning

Credit ratings are assigned in categories that indicate the level of safety and risk. Below is a general scale used by credit rating agencies:

| Credit Rating | Meaning | Risk Level |

|---|---|---|

| AAA | Highest safety | Very Low |

| AA | High safety | Low |

| A | Adequate safety | Moderate |

| BBB | Moderate safety | Slightly High |

| BB & Below | High risk | Very High |

Investors must carefully analyze the credit rating of an NCD investment before making a decision, as it directly impacts both risk and return.

Factors to Consider Alongside Credit Ratings

While credit ratings provide a strong indicator of risk, investors should also consider other factors before investing in an NCD investment:

- Interest Rate vs. Risk – Higher returns often mean higher risks. A balance is crucial.

- Issuer’s Business Stability – A company with steady cash flow is a safer bet.

- Liquidity & Tenure – Check if the NCD is listed for trading and its lock-in period.

- Tax Implications – Understand how interest income from NCDs is taxed.

Importance of Credit Ratings in NCD Investment Decisions

Investors use credit ratings as a guiding tool, but why are they so important?

- They Define Risk Levels – High ratings indicate reliability, while lower ratings suggest high risk.

- Help in Portfolio Diversification – Investors can mix high-rated and low-rated NCDs for balanced risk.

- Regulatory Compliance – Many institutional investors rely on ratings to meet financial guidelines.

The Role of Credit Rating Agencies in Maintaining Market Stability

Credit rating agencies play a crucial role in ensuring transparency in financial markets. They:

- Conduct in-depth research before assigning a rating.

- Update ratings periodically based on the issuer’s financial performance.

- Help protect investors by identifying potential default risks.

Why Do Credit Ratings Change?

Credit ratings are not static; they can change based on various factors such as:

- Financial Performance of the Issuer – A company’s profitability affects its rating.

- Market Conditions – Economic downturns may lead to rating downgrades.

- Regulatory Changes – Policy modifications can impact NCD issuers.

It is important for investors to regularly check for rating updates before making an NCD investment decision.

Myths and Misconceptions About Credit Ratings

Many investors believe that:

- A high credit rating guarantees no risk – Ratings indicate lower risk, not zero risk.

- Once rated, it won’t change – Ratings are updated regularly based on performance.

- All high-rated NCDs offer low returns – Some high-rated NCDs provide competitive interest rates.

Investors should rely on multiple factors beyond ratings when selecting an NCD investment.

How to Choose the Right NCD Investment Based on Credit Ratings

Selecting the right NCD investment requires evaluating multiple aspects along with credit ratings:

- Compare Ratings Across Agencies – Check ratings from multiple CRAs.

- Assess Financial Strength – Look at the issuer’s profitability and cash reserves.

- Check Past Performance – Has the issuer honored previous debt obligations?

Conclusion

Investors should consider credit ratings as a key factor before committing to an NCD investment, as they provide valuable insights into the issuer's creditworthiness and risk profile. A higher-rated NCD generally offers greater security, whereas lower-rated NCDs may offer higher returns with increased risks.

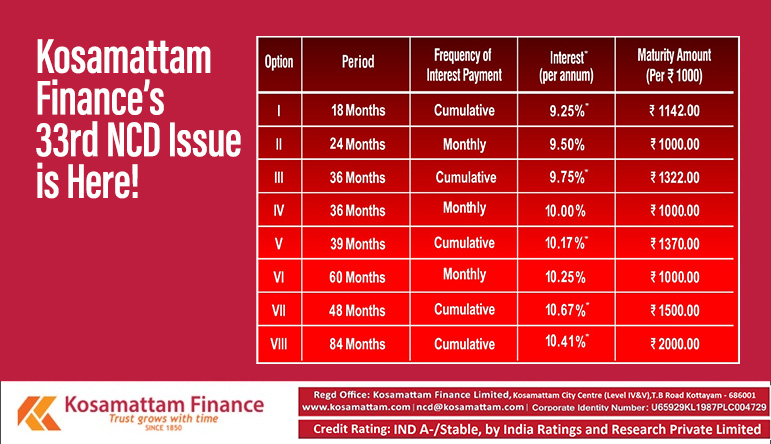

Kosamattam Finance, a trusted name in financial services, offers well-structured NCD investments backed by strong financial performance and timely interest payments. Investors looking for a stable, high-yield investment option should explore Kosamattam Finance’s latest NCD issue for competitive returns and secured investment opportunities.

Secure your investment today! Check out Kosamattam Finance’s latest NCD offerings and take a step towards smart and secure investing.